Skift Take

Cancellations and no-shows for hotel reservations tend to be higher in summertime, which can significantly impact revenue for hotels and travel management companies (TMCs). Slicing and dicing data more granularly leads to better forecasting and may reduce potential revenue losses.

This sponsored content was created in collaboration with a Skift partner.

Itâs summertime in the northern hemisphere, which means peak travel season. According to Skift Research, 65 percent of U.S. consumers took a trip in the summer of 2023, and the share who took multiple trips throughout the season grew significantly year over year from 2021 to 2023. All indications suggest that record travel numbers will occur again in 2024.

The big picture often obscures whatâs happening beneath the surface. The first monthly edition of The Data Snap series, published in May, explored why expected and actual revenues for hotel and travel management companies (TMCs) often differ, and the most recent edition, launched in June, explained why topline industry statistics are not always the best predictor of revenue outcomes. This article looks into another pivotal factor contributing to discrepancies in booked revenue vs. actual revenue thatâs particularly impactful during the summer months: cancellations and no-shows.

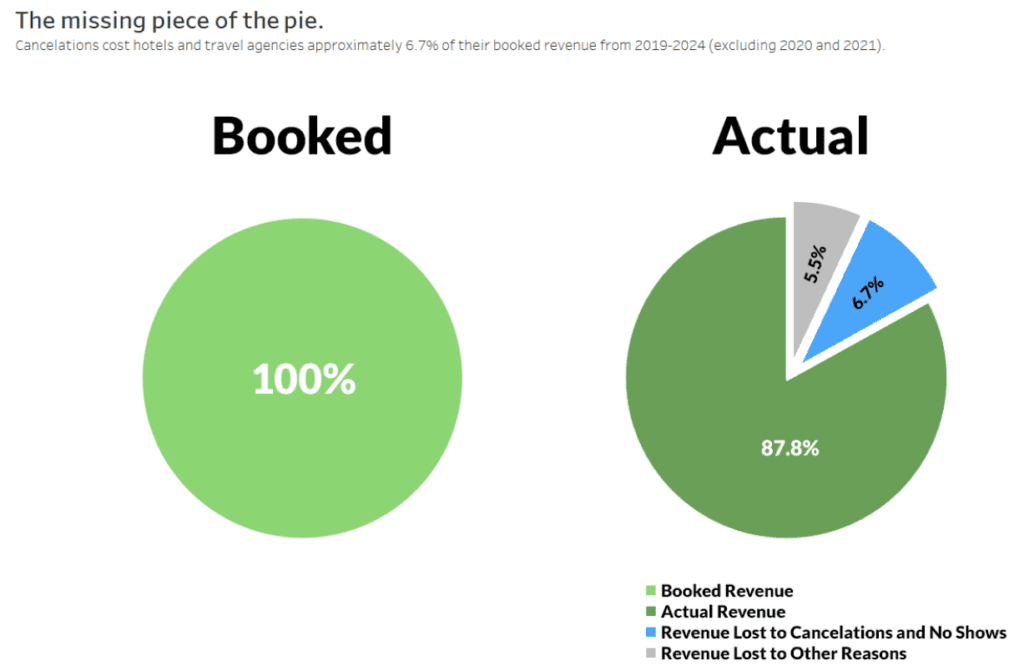

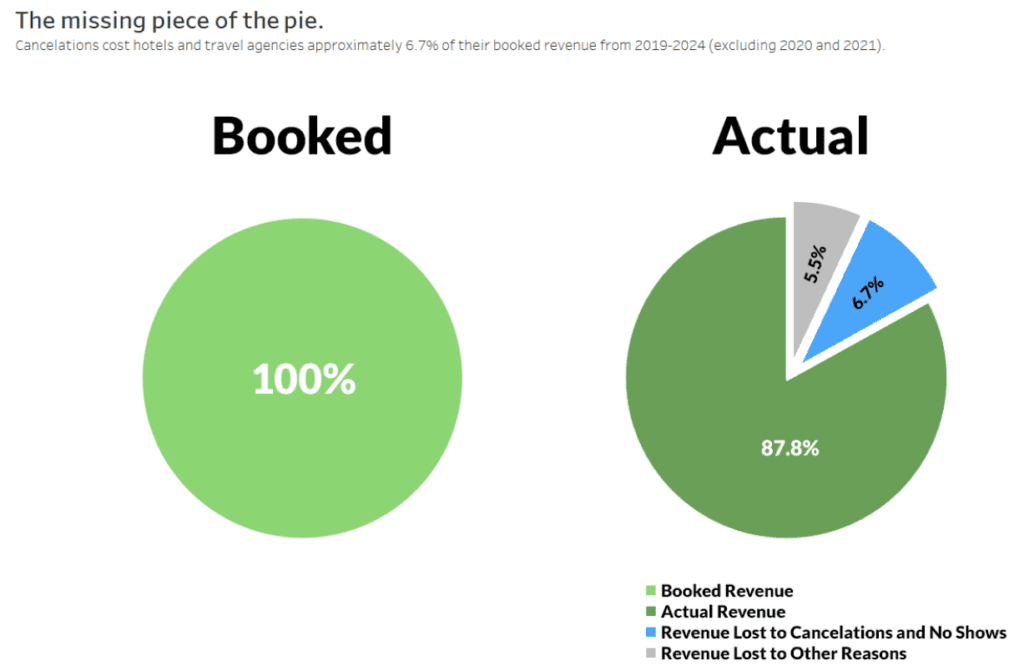

According to Onyx Insights data, TMCs have seen an average annual revenue loss of 6.7 percent over the past five years due to unaccounted-for cancellations and no-shows. This adds another variable that may occur when forecasting business impacts based only on booked data. (The other discrepancies shown below were detailed in the May 2024 Data Snap.)

Summertime Sees a Spike in Uncertainty

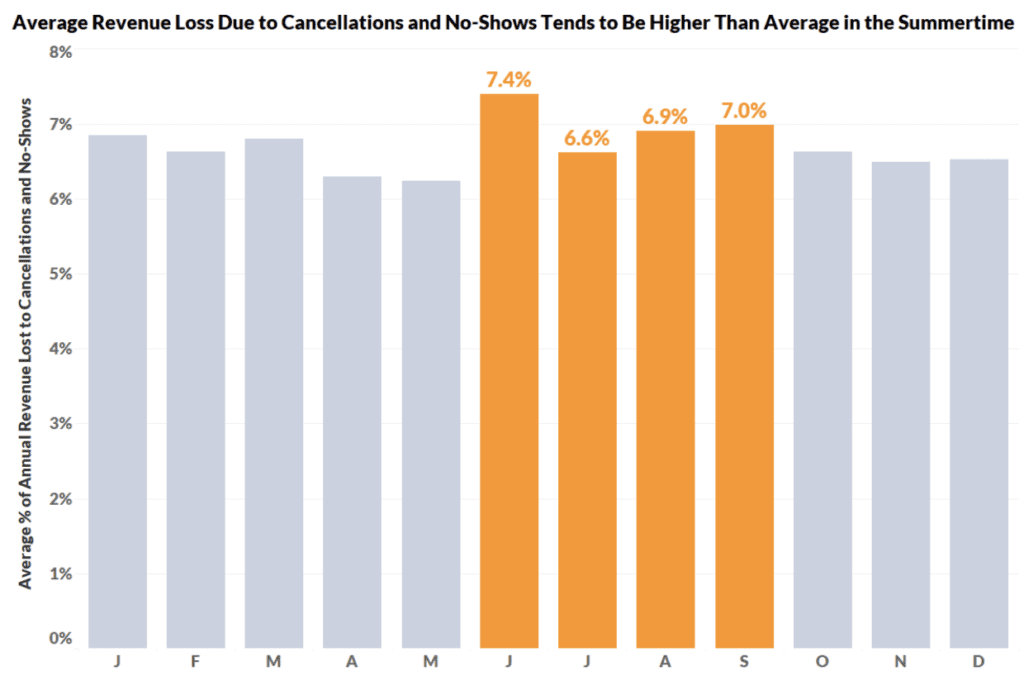

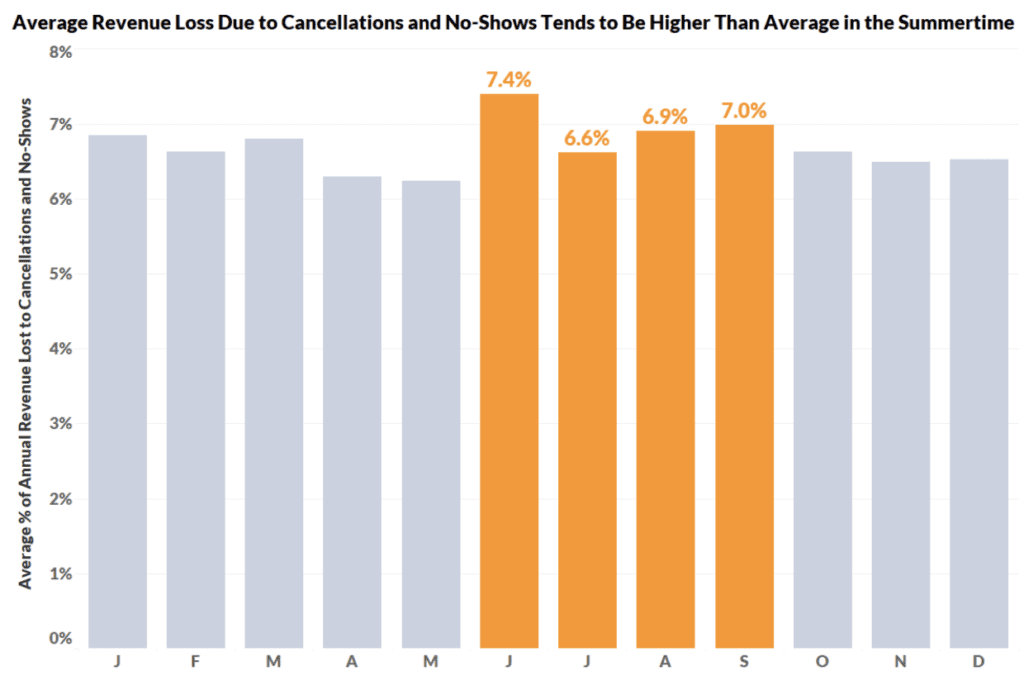

While the summer travel season is ripe for revenue opportunities, it also brings the highest volatility in hotel bookings. Since 2019*, Onyx Insights data indicates that summertime has been the pinnacle for cancellations and no-shows, with the highest average rates of revenue loss due to these disruptions occurring in June, August, and September in that timeframe. This suggests that summertime disruptions may create a disproportionate share of headaches for revenue forecasters.

Why Are Summer Travel Cancellations Higher?

Several factors contribute to summer travel cancellations, not the least of which are flight interruptions, which have a trickle-down effect on hotel stays. According to the U.S. Bureau of Transportation, flight delays and cancellations were significantly higher in June and July 2023 than in all other months and are not expected to slow anytime soon. Experts predict this year to be particularly volatile due to changing weather patterns specific to the 2024 season, a continued shortage of air traffic controllers, and crowded airports.Â

When travel is less predictable, people reflexively respond. For example, Skift Research has found on an annual basis that summer travel tends to be more heavily weighted toward vacations than trips to see family or for business. A beach vacation derailed by a grounded flight or hurricane forecast might much more easily be rescheduled or reimagined than a trip for a family gathering or a specific business event.

Moreover, summer travelers seem open to considering cancellations. The Q3 2023 Skift Research U.S. Travel Tracker â the most recent survey in this series to capture an entire summer travel season â found that travelers were most likely to choose a hotel based on its cancellation policy.

A Better Understanding of Expectations vs. Reality

Miscalculating the impact of cancellations and no-shows can have major implications for forecasting accuracy and actual revenue. The graphs below illustrate the potentially significant piece of the actual revenue pie that could be missing due to cancellations, no-shows, and other modifications â which are much more likely to occur during summertime travel. If these potential losses are not accounted for, travel companies may significantly overestimate their revenues.

Refining Summer Revenue Forecasting with Enhanced Data Analysis

The recurrent pattern of summer cancellations poses both challenges and opportunities. By comprehending the nuances of summer booking trends, companies can ensure that the peak summer season remains lucrative.

Instead of viewing the impact of cancellations and changes on booked revenues as a whole, companies can take a more granular approach by assessing transactional data by status â e.g., whether itâs commissionable or non-commissionable, canceled, or no-show.

Reviewing data with a greater level of detail will help hotels and TMCs piece together a more accurate puzzle, significantly enhancing their ability to manage expected commissions and hotel revenues for budgeting and forecasting purposes.

âThe Data Snapâ is a monthly article series that paints a clearer picture of the dynamic hotel booking landscape, empowering hotels and agencies to make data-driven decisions that help them build productive partner relationships and drive more revenue.

Onyx Insights offers a comprehensive view of the industry landscape, enabling hotels and TMCs to make well-informed decisions and better serve their clients and partners. Onyx CenterSource processes over 100 million transactions annually on behalf of 200,000 agencies and 150,000 hotels globally, representing nearly $2.1 billion in hotel commission payments. Visit onyxcentersource.com to learn more.

This content was created collaboratively by Onyx CenterSource and Skiftâs branded content studio, SkiftX.