This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

This article is based on data as of November 15, 2023. The data in this article was prepared by SQRR Research, https://sqrr.xyz

Bitcoin, Not Blockchain

Bitcoin, not blockchain. This has been a prominent meme throughout the past two epochs, guiding noobs towards a Bitcoin-only way of life, away from the fraudulent “cryptos” promising greater “blockchain tech”. Yet, here we are, more focused than ever on the blockchain. But this time it’s different: The whole world has a laser-eyed focus on the Bitcoin blockchain. The driving force for this attention is a new meta protocol — a protocol that rides on top of the Bitcoin protocol — called Ordinals. Ordinals is a novel approach to “naming” individual satoshis from the Bitcoin UTXO set, but perhaps more interestingly, it includes a way to “inscribe” data files into the Bitcoin blockchain. This article provides an analysis of how Ordinals have influenced demand for blockspace on the Bitcoin blockchain in 2023, and explores the challenges and opportunities this development presents.

Technical Overview of Ordinals

Ordinals is a protocol that’s bolted on top of the Bitcoin protocol. It is made of two distinct parts: Ordinal Theory and inscriptions. Ordinal Theory is a protocol for assigning serial numbers to satoshis, the smallest subdivision of a bitcoin, and tracking those satoshis as they are spent by transactions. This has led to some controversial conversations about fungibility as the market might assign greater value to one satoshi over another, but the market is gaining interest in this part of the Ordinals protocol. The second, and primary focus of this article, is on inscriptions. Inscriptions allow for attaching arbitrary content to individual satoshis, turning them into Bitcoin-native digital artifacts. Perhaps the easiest example to explain inscriptions would be inscribing (saving) a photo to the Bitcoin blockchain (a big storage hard drive or database) and assigning that photo to a single bitcoin satoshi. That single satoshi shows when the inscription was inscribed to the blockchain, and that inscription, or that single satoshi representing the photo, can then be transferred from one person to another. Many people do not see value in the collection or trading of these inscriptions and some go so far as to call inscriptions “spam” or a “denial of service attack” on Bitcoin, but a new market has emerged out of the Ordinals protocol and this year has shown meaningful influence on the shape, demand, and cost of blockspace. What’s more interesting are the possibilities that inscriptions bring to Bitcoin, some of which we will discuss further while many have not yet been imagined.

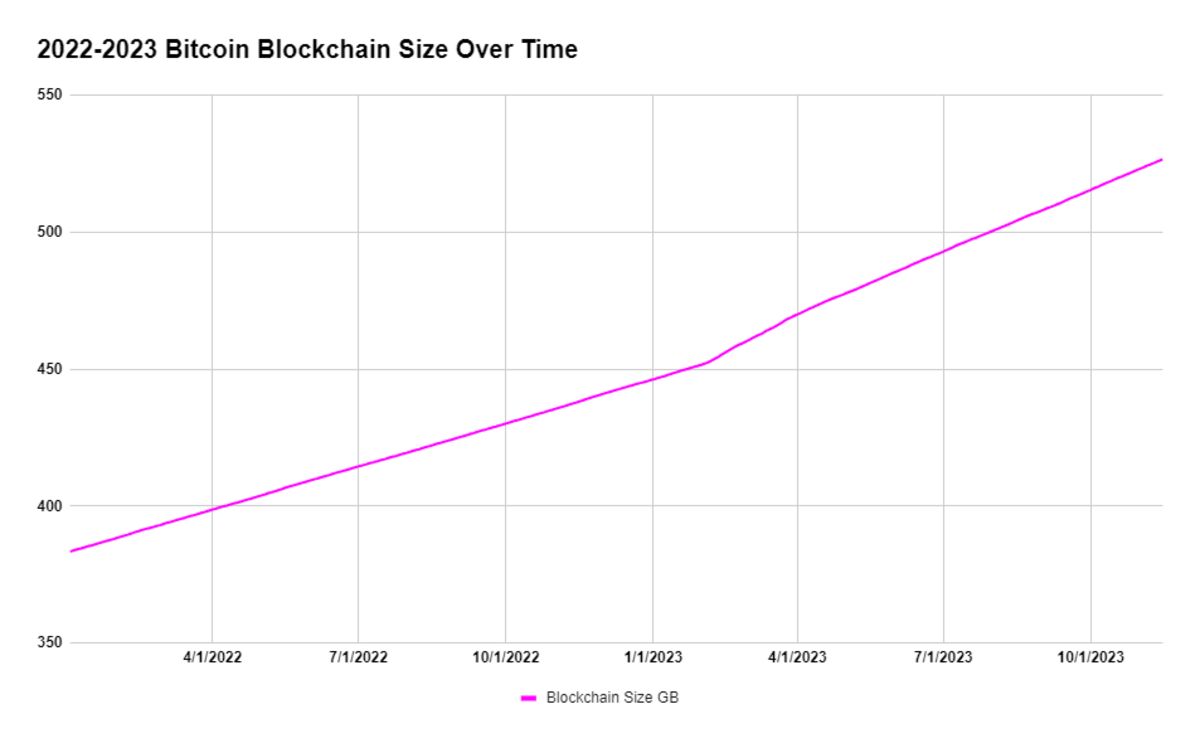

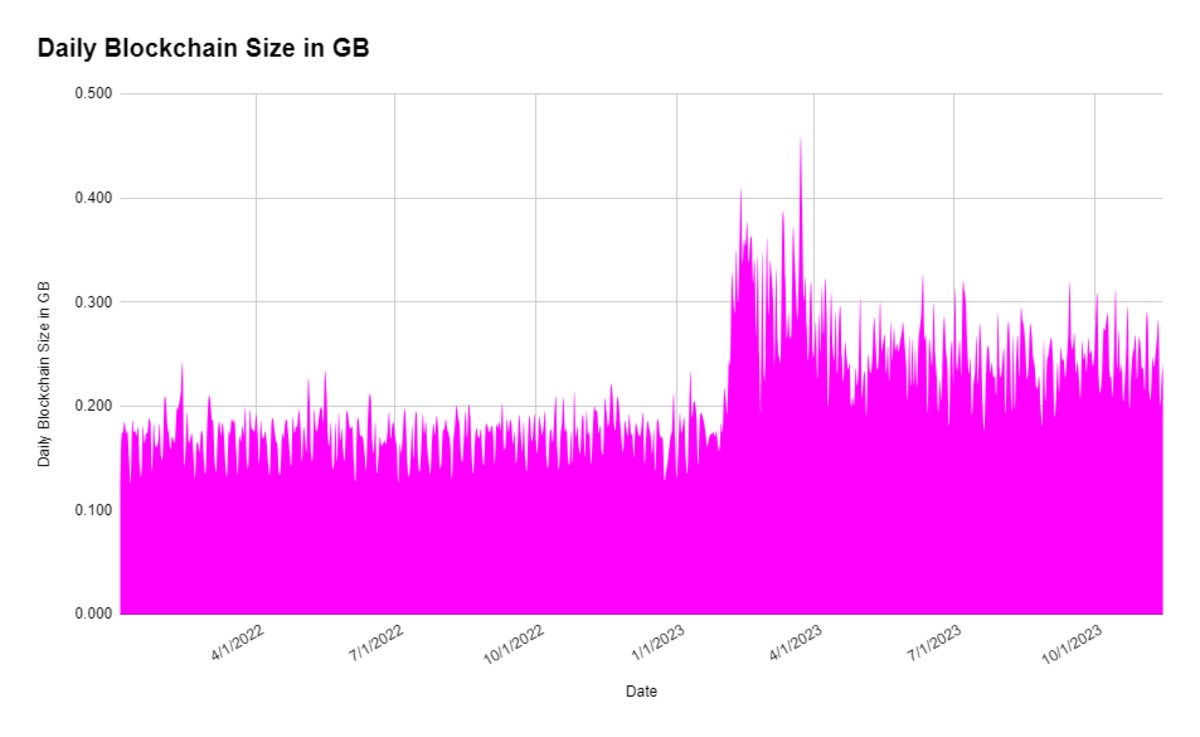

As Ordinals went from a whitepaper at the end of 2022 and well into production in 2023, we have seen a measurable increase in the growth rate of the Bitcoin blockchain. In February this year, you can see the trajectory for daily blockchain growth make a noticeable change. It’s important to note block size has not increased, rather more blockspace is being used each day. Blockspace is limited by code in the Bitcoin protocol at around ~4 MB per block. This chart shows us that in February 2023, there was a big uptick in blockspace usage.

Zooming in on the chart, you can see in February 2023 where the average block size ramps up in a meaningful way, which is attributed to widespread usage of the Ordinal protocol. We will dig into the blockspace a bit more in the next section, but the key takeaway is that the trajectory of blockspace growth has increased and this new demand does not appear to be going away anytime soon.

Analysis of Blockspace Demand

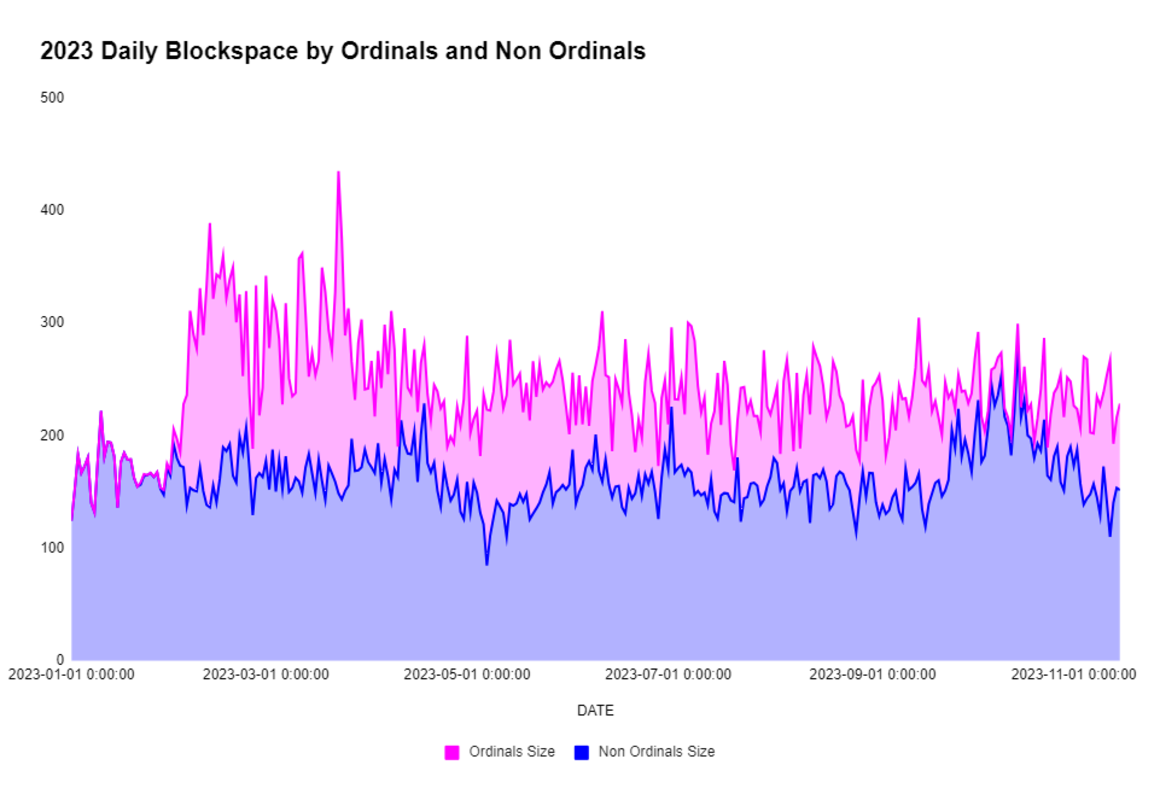

The advent of Ordinals has impacted the market demand of a limited supply of blockspace via inscriptions. These inscriptions take up bytes in each block, and those people who are inscribing inscriptions pay the dynamic market rate for that space. Since Ordinals was not yet a thing in 2022, we only saw demand for blockspace from “economic” transactions. Now with Ordinals live, we see “economic” transactions compete with inscriptions for blockspace. Since blockspace is scarce, only so many bytes — and thus transactions — can be included in each block. With inscriptions now demanding more of that space, the free market for blockspace is doing its thing and markets are clearing every 10 minutes or so.

As we dig further into the impact of inscriptions on the economics of Bitcoin’s blockspace, we will first dig into the blockspace demand in 2023. As mentioned before, Ordinals only began in 2023, so it is easy to see how these transactions have begun taking up space in blocks.

In February, you can see where Ordinals begin to have a significant footprint on blockspace. In the month of January, we saw an average of 0.5 MB of daily inscriptions added to the blockchain, but February through the rest of the year saw an average of 85 MB of inscriptions added per day.

Economic Impact

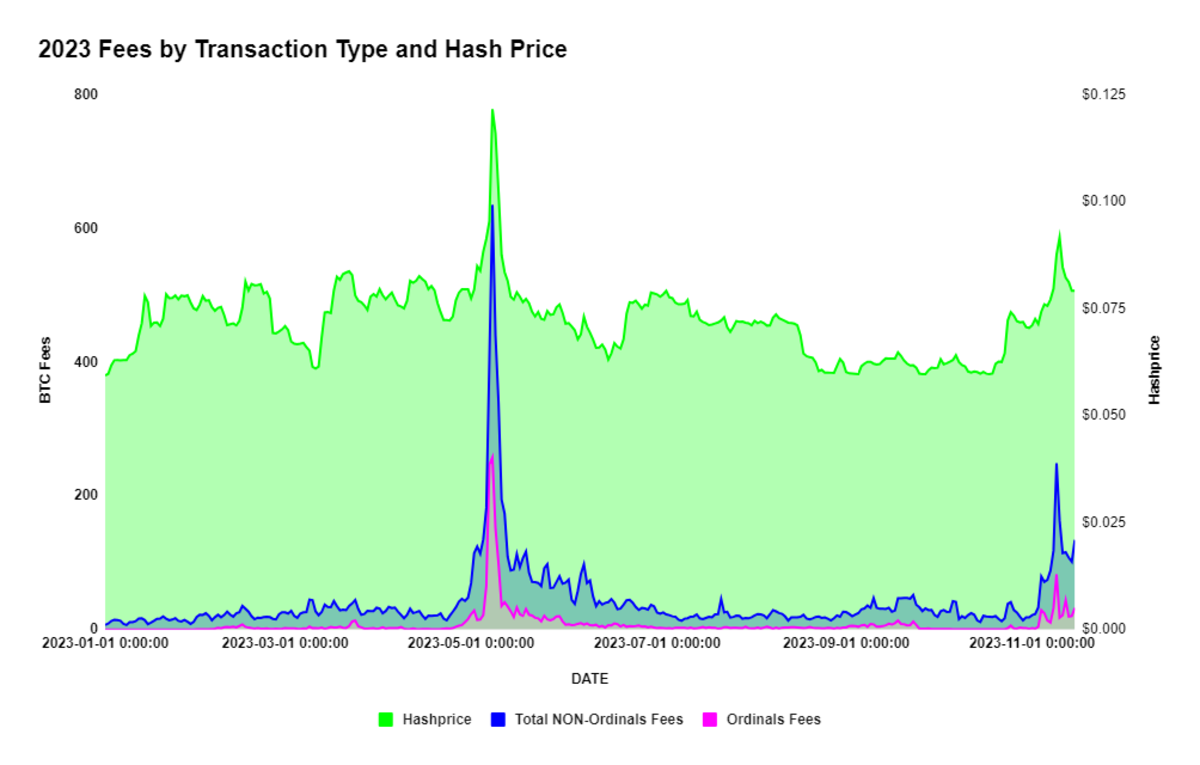

The economic implications of Ordinals are significant, particularly in the context of transaction fees and miners’ revenue. An analysis of transaction fees in 2023 illustrates a rising trend, impacting users and miners alike. Miners, in particular, have seen a notable benefit from this increase, as higher fees translate into greater revenue. In fact, over the past few years we have heard calls for the impending failure of Bitcoin if fees do not increase in a meaningful way, and with the Ordinals innovation we have seen fees increase substantially. During January 2023, we saw an average of 12.97 BTC paid in fees per day with 0.005 BTC being generated from inscriptions. But from February through November 15, we saw an average of 44.22 BTC in fees per day, a 240% increase, with 8.67 BTC of that being from inscriptions.

Considering total new bitcoin mined each day is currently around 900 BTC, total transaction fees make up only 4.5% of miners’ revenue. While this is not enough revenue to move the needle for small-to-midsize miners, this is significant for industrial-scale miners who have the added advantage of lower power costs due to buying at scale. You can see a direct correlation to hashprice and transaction fees, specifically in May 2023. The rest of the chart does not show an exact correlation, mainly because hashprice is a function of BTC priced in USD and total network difficulty. We know that as mining becomes more profitable, additional miners are turned on to take advantage of the increased revenue, and this year has seen explosive growth in mining difficulty growing from 252 EH/s in January 2023 to 457 EH/s in November 2023 — an 81% increase in just under a year.

Future Outlook and Implications for the Halving

As we approach the halving in April 2024, it will be interesting to see what happens to blockspace dynamics as the daily mining supply is cut in half. How will a hypothetical run-up in the price of BTC make sats that much more precious? Will we see continued demand for inscriptions, or will it become too costly in USD terms? Other things to consider are the emergence of new data markets within the Bitcoin ecosystem which have the potential to bring new applications and future uses of Bitcoin blockspace, going beyond traditional transactions and inscriptions. The potential of Ordinals to store diverse data types and the development of marketplaces for this data opens exciting possibilities for the future, ranging from digital art storage to complex data applications, signaling a new era in Bitcoin blockspace utility.

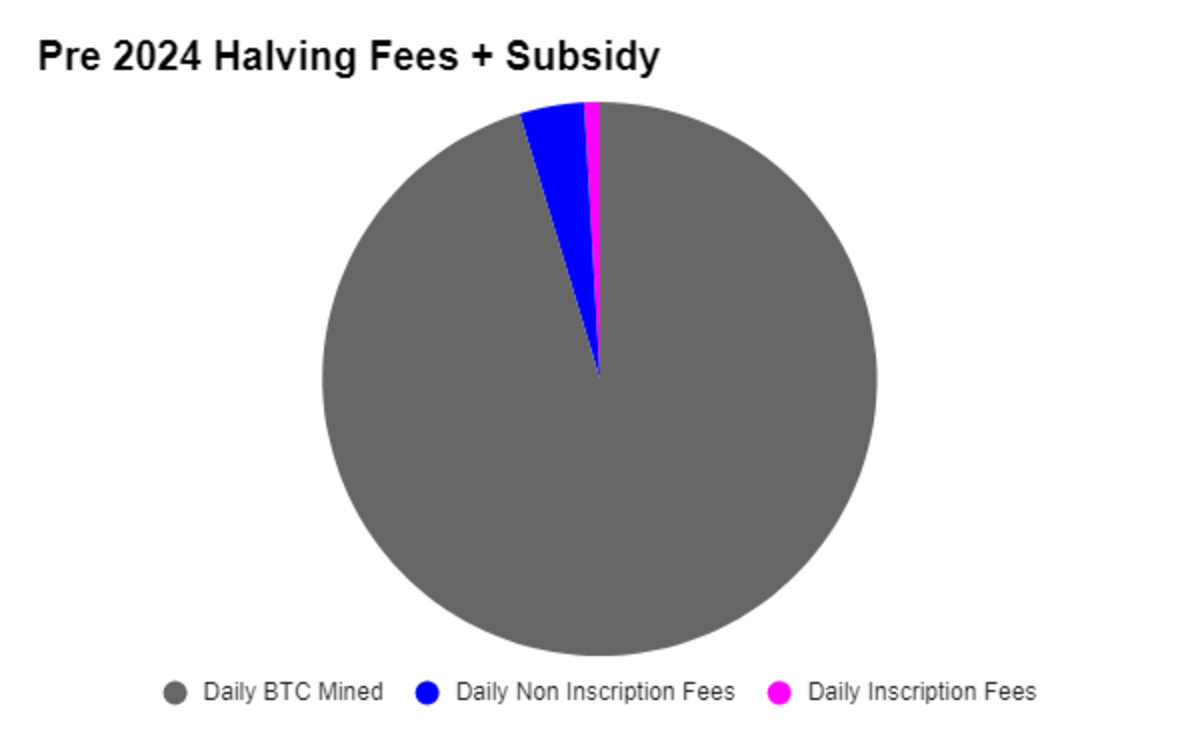

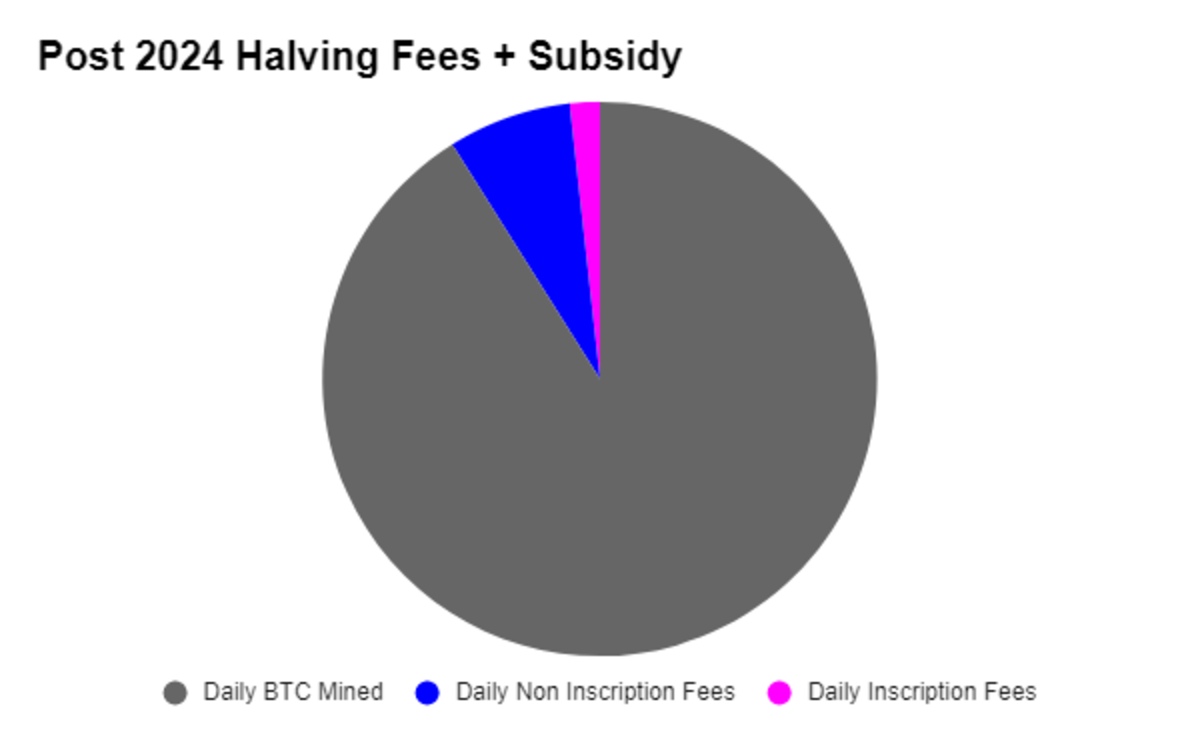

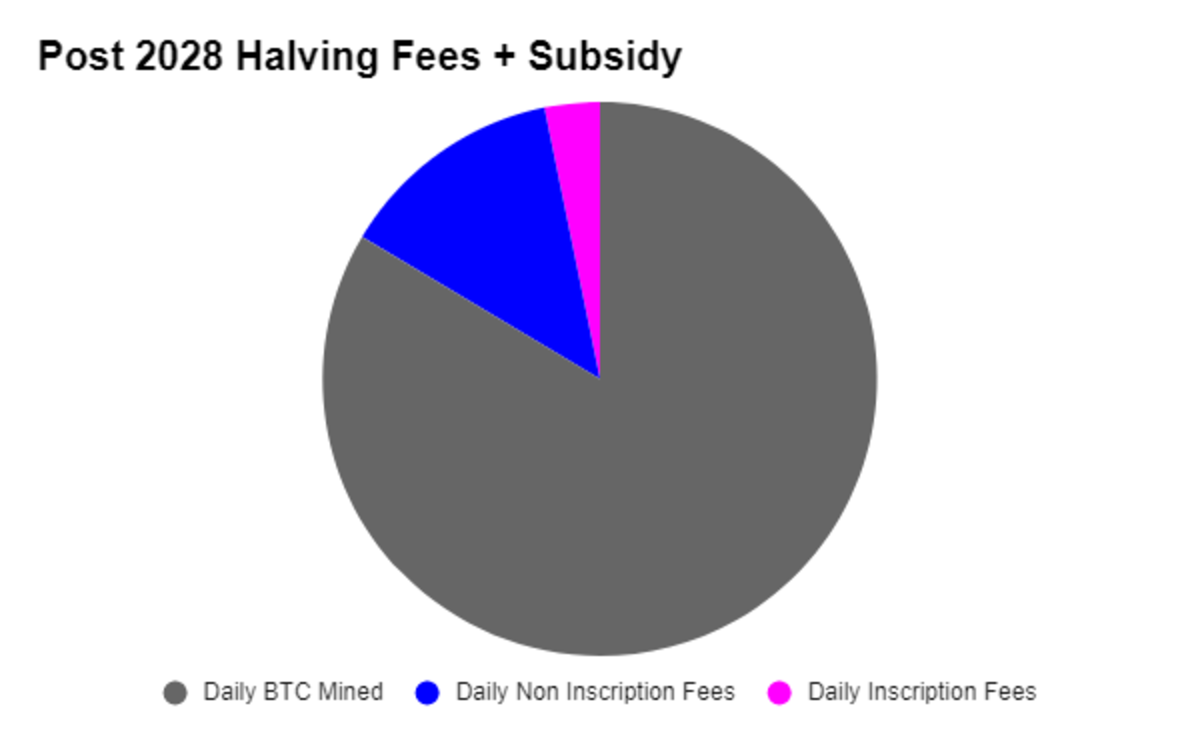

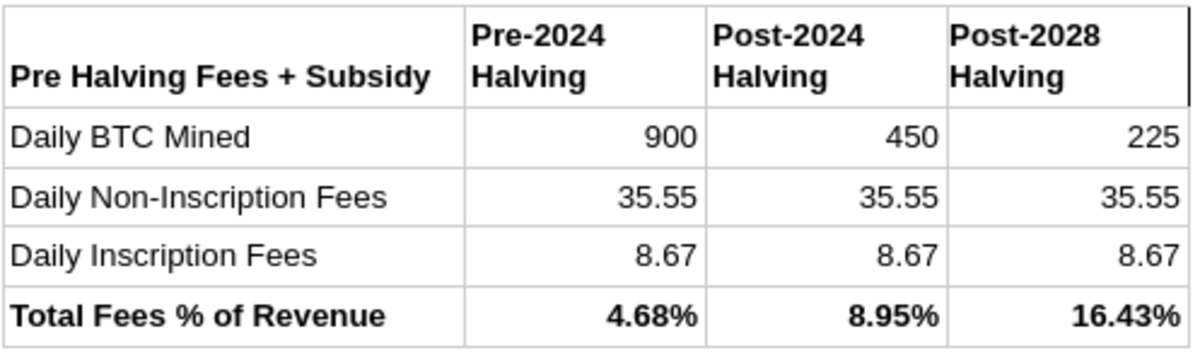

What’s exciting to ponder is what happens to the fees and subsidies leading up to and beyond the 2024 halving. Earlier we saw that if you average daily revenue from transaction fees plus inscription fees, it equals around 4.5% of miners’ daily revenue. But what happens to that post-halving? And what happens if we lived in a vacuum and kept fees flat into the 2028 halving?

If we continue at the current clip, you see that transaction fees become much more important to mining revenue after the fourth halving and carry significant value in the 2028 post-halving environment. It is hard to imagine blockspace demand staying flat through two halvings, and using current demand is quite conservative. This also discounts the invention of new ways to use blockspace which we have not yet even imagined.

Markets Clear

In closing, the emergence of Ordinals inscriptions has fundamentally reshaped the Bitcoin blockchain, marking a significant shift in both its technical landscape and economic dynamics. As we delve deeper into this new world of Bitcoin evolution, we must consider the broader implications of Ordinals and new uses of blockspace and their potential impacts. With the upcoming halving poised to introduce new supply complexities, the role of Ordinals in shaping Bitcoin’s future becomes even more interesting. From my perspective, this is a thrilling chapter in the blockchain saga, filled with uncharted territories and immense possibilities. This isn’t about JPEGs; this is about a censorship-resistant free market. As the Bitcoin protocol continues its evolution, it remains to be seen how the market will adapt to these changes and what other novel uses of blockspace will emerge. One thing is clear: The journey ahead is going to be unpredictable and weird. But at the end of the day, markets clear.

This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.