Skift Take

Jordan’s tourism sector has actually grown year-on-year, but the situation is far from perfect.

Cancellations from airlines, cruise operators and tourists themselves are hampering the progress of Jordan’s tourism sector. Prospective travelers to Jordan, that shares a border with Israel, head to the country with fears that war is just next door.

Jordan saw 2.79 million tourists in the first half of this year compared to 2.49 million travelers in the same period last year. The industry is proving robust, but a slew of cancellations from operators and concern from international travelers is stopping Jordan from seeing its true tourism potential.

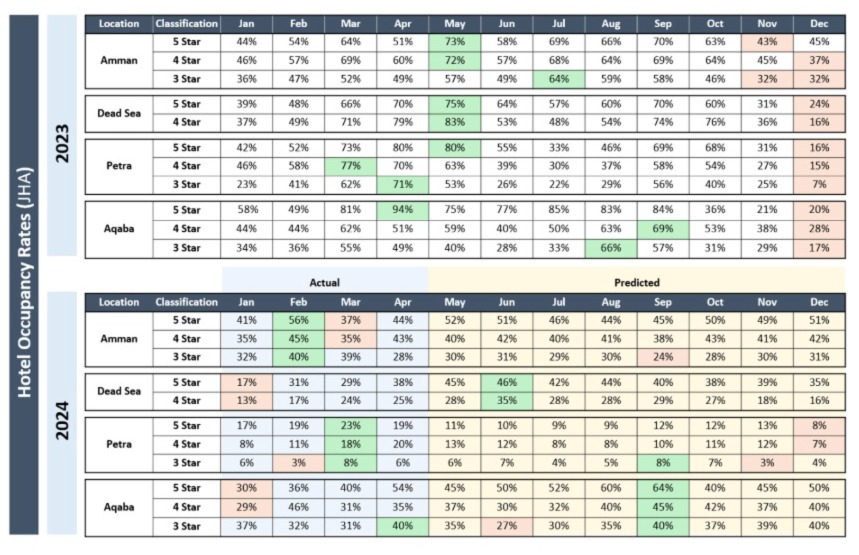

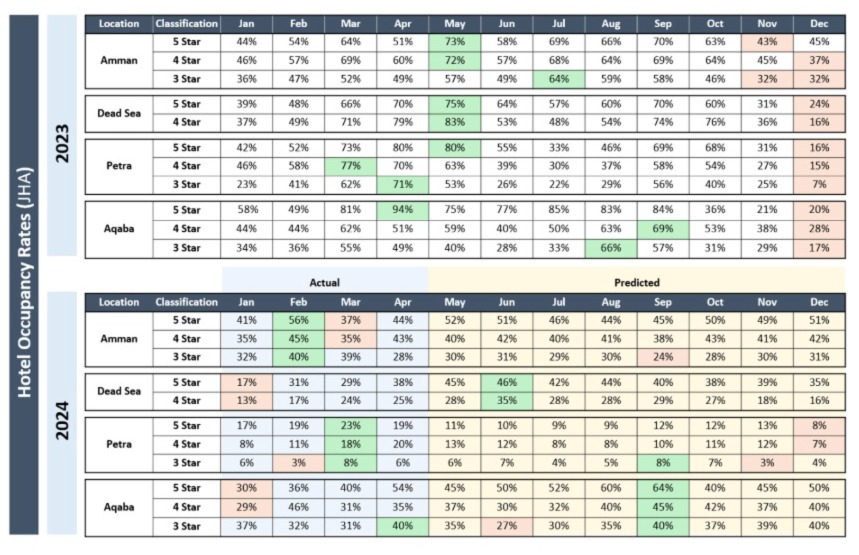

According to Jordan’s Ministry of Tourism and Antiquities (MoTA), hotel occupancies in parts of the country have been as low as 3% since the start of the Israel war last October. Generally, a hotel needs 50% occupancy to break even.

The 3% average was recorded in Petra in February across three-star hotels. In the same month, four-star and five-star hotels averaged 11% and 19% respectively.

The table below shows the occupancy rates in hotels across Jordan’s four largest tourism markets: Amman, the Dead Sea, Petra and Aqaba. It shows Petra is projected to struggle for the rest of the year with occupancies rarely going above 10%; while the capital Amman performs better with occupancies of around 50%

International Travel Sinks

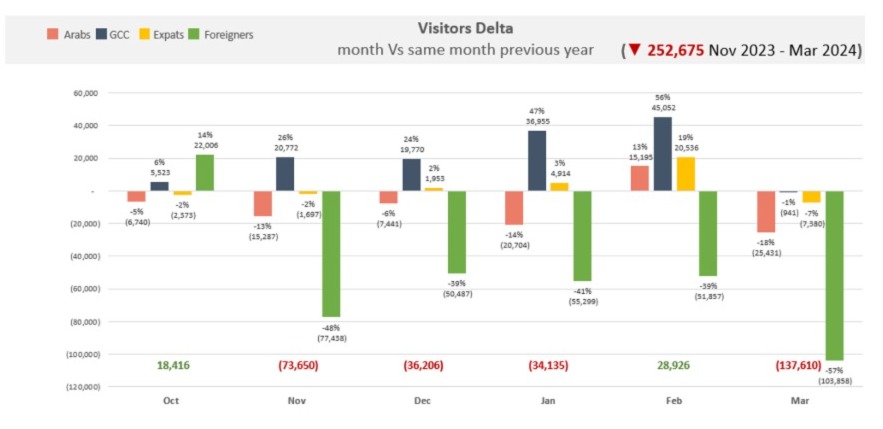

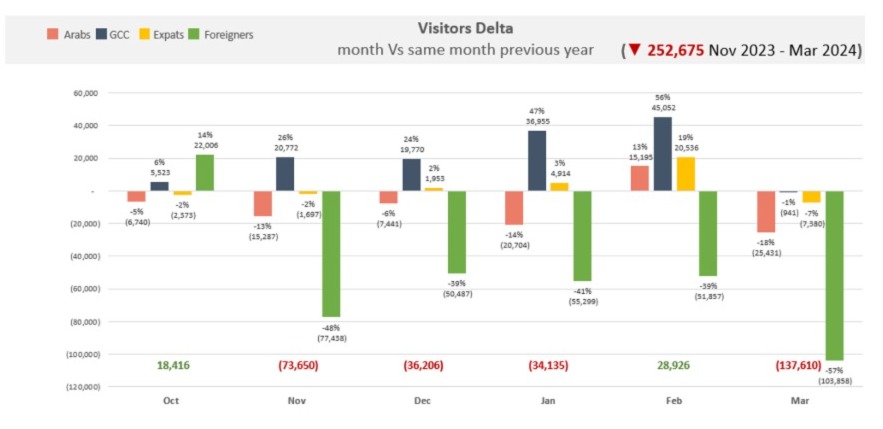

Most of Jordan’s losses are coming from a lack of international travel. Arab and GCC travelers are still going to the country, which is keeping visitor numbers up, but spending is lowering as specific source markets turn away from the country.

For the first quarter of 2024, Jordan’s tourism authority saw its international source market visits tank, while GCC visits grew year-on-year.

In a report on tourism in the first quarter, the tourism ministry said it will pursue new source markets including, but not limited to the Chinese, Russian, African, Indian, Pakistani, Malaysian, Indonesian, Arab markets, including foreigners residing in GCC countries.

MoTA estimates between November 2023 and March it has lost $287 million in potential tourism spending compared to the year before. Much of this loss comes from a lack of international spenders.

Tourism spending in the first half of this year was $3.28 billion compared to $3.45 billion during the same point last year â a 5% decrease.

Flight Operations

The war in Gaza has led to numerous airlines temporarily exiting the market, or reducing operations. Ryanair reduced its routes to Jordan from 25 to three, easyJet canceled all its flights. In 2023, these carriers operated 2,925 flights to Jordan, carrying 445,856 tourists 82% of which were international tourists.

Jordan’s tourism ministry said it will “endeavor to compensate such losses” by providing financial incentives to airline operators such as low-cost carriers, charter flights and regular operators, including Royal Jordanian.

Companies’ Cancellations in Jordan

- Cancellation of 23 charter flights to Aqaba from (October 18-December 31, 2023)

- Wizz Air: Canceled two winter season routes to Aqaba and one to Amman in February 2024

- Edelweiss Air: Canceled their only route from Zurich to Amman/Aqaba in Winter 2023.

- EasyJet: Canceled all 7 planned winter 2023 season routes to Aqaba.

- Ryanair: Planned to operate 18 routes (10 Year-Round and 8 Winter destinations) but ended up canceling 4 of these to Amman and all 7 winter 2023 routes to Aqaba. Additionally, it canceled 15 Summer 2024 routes, thus only operating three routes till October 2024

- Cancellation of 49 cruise ship trips for 2023-2024 seasons

- Over 70% of the visitors to Petra are international tourists, whose numbers declined significantly due to the war in Gaza